👋 Hi, it's Greg and Taylor. Welcome to our newsletter on everything you wish your CEO told you about how to get ahead.

Cindy and I just sold our house in the suburbs and are buying a smaller house in San Francisco (no, it’s not a homeless hellscape).

Yes, we want to be closer to the grandkids (so they learn faster to call me “Captain”), but it's also been an exercise in shrinking to grow – AKA, cutting back our capital, burn, effort and attention in order to free up resources to grow.

It was not an easy decision. We are cutting a part of our life that we deeply value – from the pickleball-friendly weather (such a boomer cliche) to the proximity to a small group of very close friends – in exchange for expected growth. But that’s the point of “shrink to grow.” It’s easy to cut when you have no choice, or what you are doing is not working.

It’s harder when you are trading something you value - to make space for new vectors of progress or joy.

But I think a lot of us could benefit from “shrink to grow” in the next 18 months.

AI, the chaos monkeys in Washington, and a looming recession will restrict knowledge economy opportunities – note Microsoft’s 3% workforce reduction this week. So can you shed some of your excess activities, spending, side hustles, etc. to create time and resources for new sources of growth or opportunity?

Here’s how to do it.

Greg

It’s not about productivity

When I say “shrink to grow,” I’m NOT talking about:

Becoming more productive through time management hacks or to-do list management

Cutting non-value-adding activities to focus on valuable ones

“Shrinking to grow” is about cutting valuable – possibly even joyful – activities or projects to execute better on a few that could offer more upside.

It’s reallocating your energy to a few things that REALLY excite you, and that you believe could grow significantly if they had more of your time or resources.

I’ll give you an example. Right now I’m very focused on building our AI point of view, which means I spend 40% of my time writing and reviewing posts, decks, YouTube scripts (coming soon), guests for Zoom chats (and maybe a podcast), etc.

I would probably be more effective if I focused on just one or two of those channels – this newsletter, for example. But it’s hard to give up the others, because they do add value and diversification reduces risk (and quells my anxiety). But at some point, I will need to invest in fewer channels, so that my audience grows faster in fewer of them.

How to know if you need to shrink to grow

Here are the things I ask myself:

Am I feeling too extended and spread too thin?

Is the quality of my work not where I want it to be?

Do I have projects on auto-pilot? (because there is really no such thing - every project sucks up your time)

Do I spend time on projects that are viable but not really thriving (e.g., growing at 5% but not 25%)

This isn’t just about being busy – it’s about selection. You can be working 60 hours a week, but if you’re focused on a few core initiatives that really excite you, it won’t feel as panicked or hectic.

Choose what to grow, not what to shrink

When most people talk about productivity, they talk about identifying activities that don’t add value and cutting those. I think that’s wrong.

To shrink to grow, start by identifying 1-2 initiatives that really excite you. Think about it like this:

Out of everything you’re doing, what do you feel most excited about?

What do you think could REALLY grow and do well, if you had more time for it?

Where do you have a “right to win” – talent, resources, etc.?

What feels like something you could be known for?

What evidence do you have that the new initiative can grow?

There may be some data you can base your decision on (e.g. growth rates, success to date, etc.), but a lot of this is just a gut instinct. That’s why it’s hard – you’re making a bet in swapping okay returns for potentially better returns.

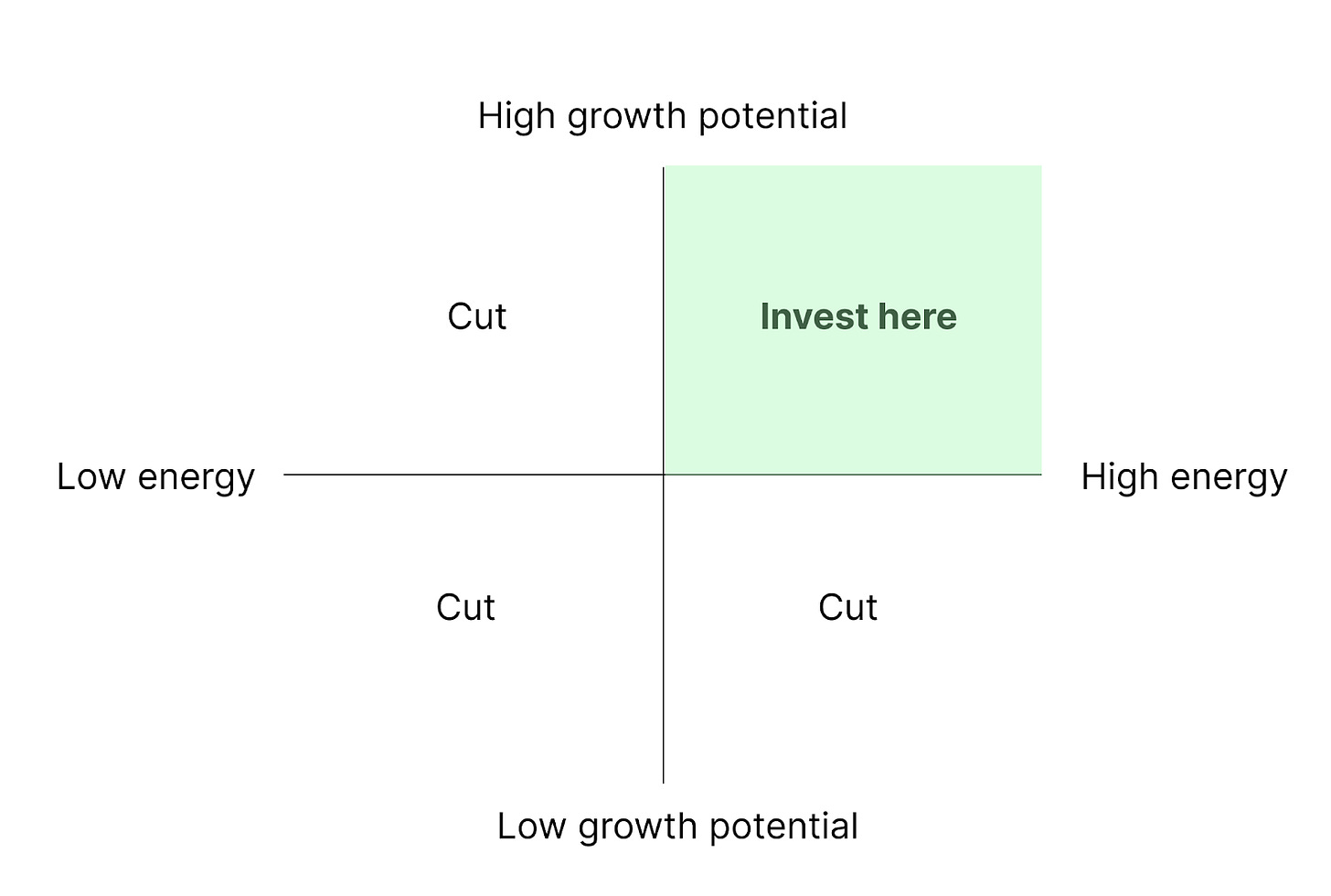

You can think about it in this 2x2. The HARDEST quadrants to cut are activities with high growth potential / low energy, or high energy / low growth potential.

Shrink 25% from there

Once you know what you’ll focus on, ask, “What activities (or capital or assets) would I have to give up to do this?”

My rule of thumb is to cut about 25% of your time or effort. Don’t just cut a couple of hours and expect that to be enough to reinvest. Remember, you should be cutting VALUABLE activities, and they should be hard to give up.

My advice: If your immediate reaction isn’t, “We can’t stop doing that,” you’re not cutting deep enough.

Time to grow

Once you’ve cut, take a beat and work on the upper right quadrant.

Pick the 1-2 best, most energizing projects from your “invest here” quadrant and build the plan:

What does success look like?

What does V1 look like?

What support and resources do you need?

What’s the first milestone that signals “keep investing”?

What will signal at 90 or 120 days that it’s not working?

My advice

You won’t know for a while if you make the “right” decision in shrinking to grow, but here are a few signs that you made a good decision:

You feel a burst of energy and enthusiasm for what you’re now investing in (hopefully this sustains)

You see an increase in the quality and focus of your work – and others notice

Within weeks or months, hopefully you see some early green shoots of growth – but remember these can take a while to show

I wish someone had taught me “shrink to grow” earlier in life. I manage my anxiety about my own value by loading up on projects. I place a lot of bets and most of them are usually decent – but I look back and see a lot of “decent” projects that should have been cut to give capital and energy to fewer, higher-potential efforts.

So sit down right now for 10 minutes, and fill out your “shrink to grow” 2X2.

Greg

P.S. By the way, we are optimizing the location of our new house for the shortest drive to see our friends. At any stage of life, never lose your core posse – some years you might have less time or proximity, but in all years, stay connected to them.

This is a great perspective and I've never thought about it in those terms - shrink to grow. Makes total sense to me. Thank you!

The 2x2 functions less as a decision-making framework and more as a way to rationalize instinct. It maps emotion, not evidence. A simple portfolio review of ROI, risk, and fit would do more than this vibes quadrant.